In the rapidly evolving landscape of healthcare and biotechnology, strategic financial leadership is more crucial than ever. Chief financial officers are at the helm of navigating multifaceted challenges that include risk management, acquisition integration, and business development. The health sector’s complexities demand a robust financial framework, and those in leadership roles must possess not only a strong grasp of financial management but also an understanding of the unique dynamics that govern industries focused on life sciences and patient care.

As professionals with MBAs from prestigious institutions like the Kelley School of Business at Indiana University step into CFO roles, they bring a wealth of knowledge and experience. Whether overseeing operations at OakBend Medical Center or driving financial strategies at leading biotech firms like Orthofix International and Eli Lilly & Company, these leaders prioritize relationship building and mutual respect to cultivate productive teams. Their ability to enhance operational efficiency, implement cost reduction initiatives, and manage debt effectively shapes the future of organizations amidst the ever-tightening competition for private funding and innovative breakthroughs in cellular immunotherapies and cancer treatment.

Learn More from Jeffrey Hammel

The Role of the CFO in Healthcare

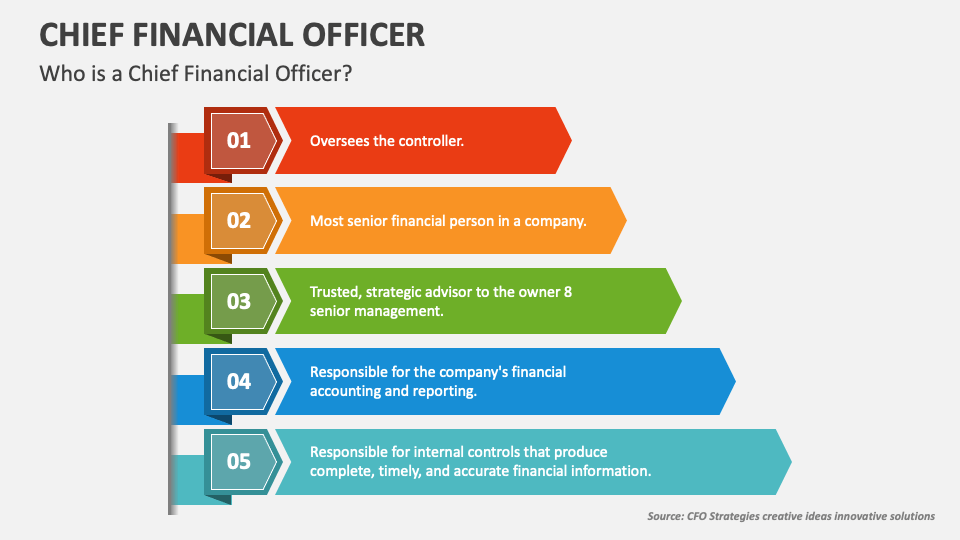

The Chief Financial Officer, or CFO, plays a critical role in the healthcare sector, acting as a strategic partner in navigating the complex financial landscape. With responsibilities spanning financial management, risk management, and acquisition integration, the CFO ensures that organizations like OakBend Medical Center are well-positioned to meet both current and future challenges. Effective financial stewardship is essential as they align resources with the organization’s mission, ensuring that operational strategies are supported by robust financial planning.

In addition to traditional financial oversight, the CFO is instrumental in fostering relationships with stakeholders, including the board of directors and external partners. By building mutual respect and trust, the CFO enhances collaboration across corporate operations, which is particularly important when addressing the needs of diverse healthcare models. This relationship-building aspect is crucial for successful business development and navigating the intricate dynamics of the healthcare industry, where changes are rapid and often unpredictable.

The landscape of healthcare and biotechnology is continuously evolving, necessitating a CFO who can drive productivity improvement and cost reduction initiatives while managing debt effectively. By leveraging their skills in financial management and operational efficiency, the CFO becomes a key player in the organization's growth strategy. They facilitate the integration of new technologies, such as cellular immunotherapies for cancer treatment, and efficiently navigate private funding opportunities, helping to maintain the organization's competitive edge in a challenging market.

Risk Management Strategies

In the healthcare and biotech sectors, effective risk management is essential for safeguarding assets and ensuring sustainable growth. Chief Financial Officers play a pivotal role in identifying potential risks, such as regulatory changes, market fluctuations, and operational inefficiencies. By conducting comprehensive risk assessments, CFOs can devise strategies that prioritize risk mitigation while aligning with organizational goals. This proactive approach enables companies to navigate uncertainties, protect their investments, and maintain a competitive edge.

Collaboration between finance and operational teams is crucial in developing successful risk management strategies. CFOs must foster an environment of mutual respect and open communication, allowing for the sharing of insights and concerns regarding potential risks. By building strong relationships across departments, financial leaders can ensure that both financial and operational perspectives are incorporated into risk management discussions, leading to more robust solutions. This level of integration not only improves organizational resilience but also enhances overall productivity.

Moreover, the incorporation of data analytics and technology into risk management processes can significantly improve decision-making. With advanced analytical tools, CFOs can monitor key performance indicators and real-time data, enabling them to anticipate and respond to risks more effectively. Additionally, by leveraging financial modeling and forecasting techniques, organizations can assess the potential impact of risks on their financial performance. This data-driven approach ensures that risk management strategies are not just reactive but also anticipatory, positioning health care and biotech firms for long-term success.

Acquisition Integration and Growth

Acquisition integration plays a crucial role in the growth strategy of healthcare and biotech organizations. Successful integration allows companies to harness synergies from new acquisitions, improving operational efficiency and enabling faster entry into new markets or therapeutic areas. For a chief financial officer, managing this process involves understanding both the financial implications and the cultural dynamics at play. By leveraging strong relationships within the organization and fostering mutual respect, CFOs can facilitate smoother transitions and ultimately enhance productivity.

Learn More from Jeffrey Hammel

Effective leadership during acquisition integration is essential to align the goals of both entities involved. A CFO must work closely with the board of directors to establish a clear business strategy, ensuring that all stakeholders are on the same page. Integrating diverse corporate operations requires careful planning and a robust risk management framework to address potential challenges. This strategic oversight is vital in maintaining investor confidence and securing private funding, especially in a highly competitive landscape where the stakes are high.

As organizations grow through acquisitions, it is important to focus on continuous improvement in finance operations. By implementing strong financial management practices, including cost reduction strategies and debt management, CFOs can drive value creation. The experience gained from previous roles in auditing and controllership, such as at KPMG or in senior auditor positions, equips financial leaders with the necessary tools to navigate the complexities of integration. Ultimately, a successful acquisition not only contributes to immediate growth but also sets the foundation for long-term sustainability in the ever-evolving healthcare sector.

Financial Planning and Development

Financial planning and development in the healthcare and biotech sectors are crucial for ensuring sustainable growth and efficiency. Chief Financial Officers, or CFOs, play an integral role in this process by developing comprehensive financial strategies that align with the organization’s overarching business goals. By leveraging their expertise in financial management, CFOs can navigate the complexities of risk management and acquisition integration, ensuring that investments support long-term objectives. This strategic approach not only fosters fiscal responsibility but also positions organizations for future success in a highly competitive landscape.

In the healthcare industry, the demand for robust financial planning is further amplified by the rapid advancements in biotechnology and treatment modalities, such as cellular immunotherapies and cancer treatments. CFOs must work closely with business development teams to identify potential funding sources, including private funding and partnerships with established companies like Eli Lilly & Company and Orthofix International. By forging strong relationships with investors and stakeholders, financial leaders can facilitate capital inflows that enable innovation and expansion, which are essential for maintaining a competitive edge.

Ultimately, fruitful financial planning hinges on the principles of mutual respect and trust within corporate operations. Successful CFOs understand the importance of fostering a culture that emphasizes relationship building and team collaboration. By encouraging open communication and shared goals among departments, financial leaders can implement strategies that drive productivity improvement and cost reduction. This holistic approach not only enhances operational efficiency but also empowers organizations to adapt to evolving market dynamics while achieving their financial objectives.

Operational Efficiency in Finance

Operational efficiency in finance is crucial for healthcare and biotech organizations aiming to thrive in a competitive landscape. By streamlining financial processes, businesses can allocate resources more effectively and enhance overall productivity. The role of a CFO is pivotal in leading initiatives that identify inefficiencies, implement process improvements, and leverage technology to facilitate smarter financial decision-making. This strategic approach not only reduces costs but also fosters an environment that prioritizes agility and responsiveness to industry changes.

Learn More from Jeffrey Hammel

Effective risk management is an essential component of operational efficiency. CFOs must develop frameworks that allow organizations to anticipate and mitigate potential financial risks while ensuring compliance with regulations and standards. A strong focus on audit and controllership underpins this stability, providing the necessary checks and balances to safeguard organizational assets. As the demand for advanced treatments in areas like cellular immunotherapies and cancer care increases, the ability to navigate risks associated with investments and operational decisions becomes paramount in maintaining a competitive edge.

Furthermore, fostering a culture of mutual respect and trust within finance teams can significantly enhance operational efficiency. By prioritizing relationship building and open communication, CFOs can empower their teams, encouraging collaboration that drives innovation and success. When finance professionals feel valued and engaged, their contributions lead to improved outcomes in finance operations, ultimately benefiting the entire organization. This holistic view of operational efficiency ensures that financial management aligns with the overarching goals of healthcare and biotechnology entities, propelling them toward sustainable growth.

Learn More from Jeffrey Hammel

Building Relationships and Trust

In the dynamic landscape of healthcare and biotech, building relationships and trust is paramount for a chief financial officer. A CFO must foster connections not only within the finance team but also across various departments and with external stakeholders. Establishing mutual respect helps create a collaborative environment where all parties feel valued and are more willing to contribute to the organization's objectives. This is particularly important in sectors where operational efficiency and strategic alignment are crucial for navigating the complexities of risk management and acquisition integration.

The effectiveness of financial management often hinges on the ability to communicate effectively with the board of directors and corporate operations. By cultivating open lines of communication, a CFO can ensure that the leadership team is aligned with the financial strategies that drive productivity improvement and cost reduction. These relationships pave the way for informed decision-making, allowing the organization to leverage its resources more effectively and respond adeptly to the challenges of the healthcare industry.

Moreover, trust is fundamental in business development and during periods of significant change, such as mergers or fundraising efforts. Establishing a reputation for integrity and transparency cultivates confidence among partners and investors, which can lead to increased private funding opportunities. A successful CFO embodies the principles of respect and trust, not only focusing on financial metrics, but also on team building and fostering a culture where everyone is motivated to contribute to the overarching mission of improving cancer treatment and advancing biotechnology.

Success Principles in Financial Leadership

In the complex landscape of healthcare and biotechnology, effective financial leadership is essential for navigating the myriad challenges that arise. A CFO must possess a strong foundation in financial management, complemented by an MBA from a respected institution such as the Kelley School of Business. This academic background equips leaders with strategic thinking skills and a deep understanding of risk management, essential for making informed decisions that drive business success. By integrating financial acumen with operational insights, a CFO can align financial goals with broader organizational objectives, ensuring sustainable growth.

Relationship building stands as a cornerstone of successful financial leadership. Establishing mutual respect and trust among the leadership team, board of directors, and other stakeholders fosters a collaborative environment that enhances productivity and innovation. A CFO who prioritizes open communication can effectively advocate for the organization’s financial needs while understanding the perspectives of various departments. This approach not only aids in acquisition integration and business planning but also strengthens the CFO's role as a strategic partner in the organization, facilitating smoother transitions and alignment during periods of change.

Lastly, a commitment to continuous improvement is vital. Successful financial leaders actively seek opportunities for cost reduction and operational efficiency, implementing practices that enhance finance operations within their organizations. By embracing a culture of respect and trust, CFOs can motivate their teams to adopt success principles centered around accountability and results. As the healthcare and biotech industries evolve, the ability to adapt and innovate in financial strategy will be crucial for sustaining success and advancing healthcare solutions, such as cellular immunotherapies and cancer treatment advancements.